NOTICE

You are being transferred to Angel Loans (Silverline Autos Limited). LoanOnYourCar (J2P Autos Limited) does not receive any commission or fee from Angel Loans for referrals or transactions.

Press proceed to continue.

16.07.2020 by Adam F

Throughout the last few months, the UK has seen a significant impact on employment rates due to the pandemic.

Whilst it’s gradually starting to pick up as the restrictions ease and life starts to get back to normal, the data recorded during lockdown shows its drastic effect on employment. For example, between January and March, it was discovered that unemployment was 3.9% – which was 0.1% higher than in the same period in 2019.

Even though the statistic was lower than economists expected, it has still played a large part in the overall state of the economy. The number was likely lower than predicted due to the fact that the UK government had created useful schemes to help ease the financial burden caused by the virus - such as the much-praised Job Retention Scheme.

Although this only applied to those who were on furlough, those who could not work because they were infected or weren’t eligible for Statutory Sick Pay, the scheme amongst several others have assisted people across the UK throughout the last few months.

Other countries around the world followed suit, creating schemes that offered a certain amount of money to unemployed people each week. One, in particular, that was prominent in the headlines was within the US.

Despite this scheme, due to the ever-increasing number of unemployed people in the country (now sitting around the 36 million mark), the money rapidly dried up – contributing to more and more people looking for a debt relief solution.

According to a survey conducted by the Office of National Statistics, even though the schemes were helpful in the UK, 23% of businesses either closed or paused trading.

Even though less than 1% of businesses permanently ceased trading, the numbers still represent how the pandemic has impacted their sales revenue.

Many different industries have felt the strain of the pandemic, from hospitality to travel and retail. Contributing to thousands of job losses throughout the country, almost everyone has been affected by it.

By viewing the above news report, it’s clear that even the more prominent retailers have been affected. And while they may come out of it, smaller businesses will not be as lucky regardless of the assistance offered to them from the government.

Due to the pandemic, the number of people seeking work-related benefits because of unemployment has also risen significantly throughout the last few months.

Rising 23% to 2.8 million in May according to the recorded data, the numbers can’t be ignored. Paired with statistics based around jobcentre claimants (this number increased to 126% since the start of lockdown), shows the impact on many households across the country – and especially those with lower income.

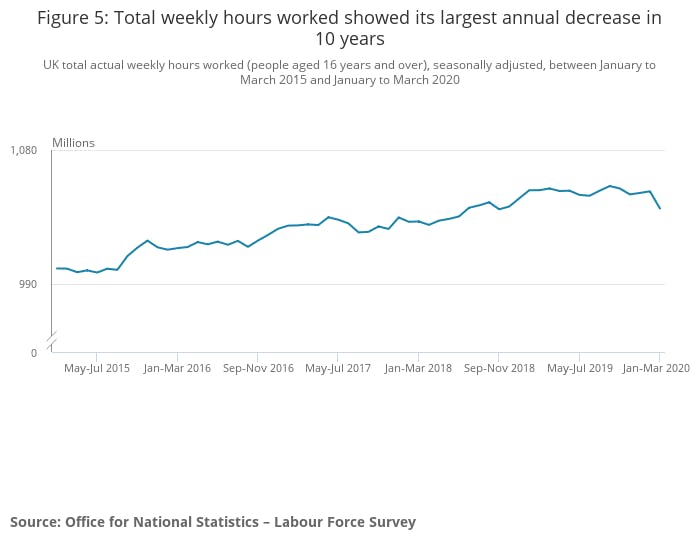

Along with the rise in the need for work-related benefits, data also showcased that in comparison to January and March last year, the total weekly work hours have decreased exponentially.

Falling by 12.4 million (as represented in the graph below), it similarly shows how the virus has affected the overall earnings of households. Interestingly, through the survey, it also discovered that the hours worked by men fell by an average of 1.1 hours, while women’s decreased 0.4 hours.

Through the same Labour Force Survey, it was also uncovered that between March and May 2020, the number of employees on the Pay As You Earn system fell by 2.1% (612,000). Even though these were new statistics - it seems the numbers are now evening out, the real impact that the virus has had on the economy won’t be felt until the end of this year.

Alongside the Job Retention Scheme listed above, the government also introduced support for self-employed people. Entitling them to 80% of their average monthly profits, this scheme has three phases that have helped to ensure that they had enough income to cover a portion of their losses due to the pandemic. The Universal Credit scheme was also designed to help those on low incomes throughout the next year.

As part of combatting the economic challenges of the virus, the Bank of England has also introduced schemes to assist both UK households and businesses that are struggling. These measures introduced by the bank are designed to prevent economic harm in the long term.

From reducing the bank rate and launching a Term Funding Scheme for small and medium businesses, to reducing the UK countercyclical capital buffer rate, these steps could prove to be invaluable not only in the present but as the UK starts to rebuild its economy. For the latter, this will make it easier for borrowers across the UK as it supports banks (up to an incredible £190 billion) when supplying them with credit.

One big concern of individual borrowers throughout the pandemic is what the lenders will do. Initially worried that they would continue to take loan payments despite becoming unemployed, it put a lot of stress and strain upon their shoulders.

It’s therefore essential to identify what lenders are doing in this time to help. Listening to professional advice and their customers’ concerns, many financial institutions across the UK have announced useful relief measures to help those affected by the virus – from scraping fees to payment holidays.

Some of the most prominent and helpful assistance has come from the Financial Conduct Authority. Released on 9 April 2020, they recommended that if you have a personal loan and you’re unable to pay it due to the Coronavirus, you can apply for a partial payment freeze or a complete payment freeze.

Something that you can apply for up until the 31 October 2020, will ensure that you can gather the money that you need when the repayments begin again. A big consideration with this, however, is that it is only temporary and must be repaid once the payment freeze has come to an end. A way of temporarily deferring the loan can make your life much more relaxed during these challenging times.

It’s good to know that this freeze is also available across both guarantor loans and logbook loans. A bonus that many people will undeniably be happy with, all you have to do to freeze it is contact your lender. They are legally obliged to offer this within three months.

It’s essential also to recognise that if you’re able to keep up with the repayments, it’s better to do this unless it’s vital to apply for a payment freeze. Why? Because over the time of the payment freeze, the interest that’s attached to it will continue to build. This results in you having to repay more in the future.

However, despite many lenders applying interest to the loans, not all lenders will do this during this time. Some may offer an interest-free deferment. To ensure that you know how much you’re paying, contact your lender as soon as possible to find out more.

For those who are on motor finance and are having difficulties meeting leasing payments due to the Coronavirus, this payment freeze also applies. As part of this, the FCA has requested that firms do not alter any Personal Contract Hire or Personal Contract Purchase agreements.

Consumers that have mortgages but can’t afford to repay them at the moment can also apply for a mortgage payment holiday through their bank. Lasting up to three months, this holiday could provide much-needed help when you require it. Once you contact your lender, they will put a fast track process in place that details your inability to repay what you owe at that time.

Similarly, certain banks throughout the country are changing their policies to offer interest-free overdrafts. Another step that will help to ease the burden of debt, it’s good to check whether your bank has this policy in place if it’s looking like you’re going to fall into your overdraft.

No matter what loan you have at the moment, it’s worth contacting the lender to see what actions they are taking to help. There’s no reason why you can’t ask for a payment freeze if they are offering them to their customers – so make sure that you don’t get into more debt, and you take a proactive step as soon as you can.

Another big concern that people might have is what effect the above schemes will have on their credit score. And you’ll be pleased to know that these temporary measures shouldn’t have an impact. A plea by the FCA, it has tried to advise lenders to guarantee that none of the schemes, whether it be a mortgage holiday or a payment freeze have any detrimental effects on a consumers rating or credit report.

TransUnion, Equifax and Experian which are the UK’s leading Credit Reference Agencies have agreed to this, creating new guidance surrounding it.

So are people still actively seeking loans at this time? Despite many people being recommended to stop taking out loans if they cannot afford the repayments, people are still taking loans out to try and cover the debt they have accrued.

One of the first steps taken by those unable to earn money during this time, it is seen as a necessity that is worth the repercussions. Plus, due to the pros that come with it (such as the payment freezes listed above), it is easy to see why it could be a tempting move.

For example, many businesses are turning towards the government’s Coronavirus Business Interruption Loan (CBIL) as a way of protecting their businesses throughout the lockdown. With this type of loan, companies can access up to 80% of what they would have earned (up to 5 million).

Despite this being valuable for some businesses who have an annual turnover of up to £45 million, it may require you to borrow against your house. It also comes with up to 22% interest applied to it – something that could bankrupt smaller businesses that are already struggling without earning any money throughout the pandemic.

As well as the CBIL, the government has also introduced the Coronavirus Bounce Back Loan. Allowing businesses to borrow up to 25% of their turnover, it’s seemingly a beneficial loan scheme because a business’ will only have a 2.5% interest rate applied after 12 months. However, with any loan, there are eligibility requirements and fine print that might not make it suitable for every business.

In terms of personal loans, it’s clear that payday loans are just one of the most significant ones that are undeniably being taken out during this time of economic unrest. A surge that was predicted by economics, it’s one that will undoubtedly continue as the economy starts to regain its strength.

However, with all types of loans, if you’re considering taking one, you must read thoroughly into what the repayment plan includes so that you’re not caught out by any high-interest rates.

Overall it’s clear to see the enormous impact that the pandemic has had on employment rates in the UK. From the number of people having to seek welfare benefits to businesses seeking loans to cover their losses, the effect it’s had on both individual consumers and business is unfathomable.